.png)

Payments flexibility improves payroll processing at your organization

Eric Little

Product Manager

Here at Check, we understand that paying employees and contractors the money they’ve earned is not always as simple as it sounds. From calculating total earnings, to filing payroll taxes, to actually delivering payment — there is a lot that goes into successfully processing payroll. That’s why we are focused on building products that make payroll processing more flexible, reliable, and transparent for everyone in your organization.

This week, we’re excited to announce a set of new functionality and improvements to our payroll processing flows. The release includes net pay splits, improvements to payment visibility, failed payment recovery, and bank account validation.

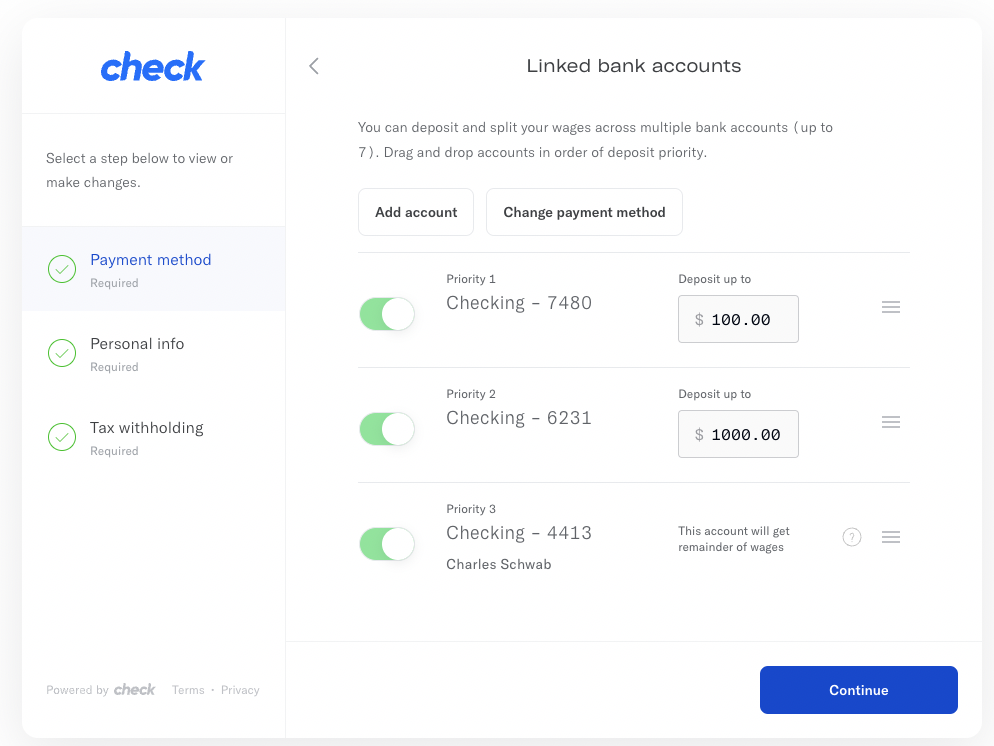

Pay Splits

This was one of our most requested features to date, and for good reason -- people should be able to segment their earnings in the way that works best for them. Now, partners who build on Check can offer employees the ability to split their pay into multiple bank accounts. From practicing financial wellness to supporting family members, employees will be able to divert their earnings to the accounts that best suit their financial needs.

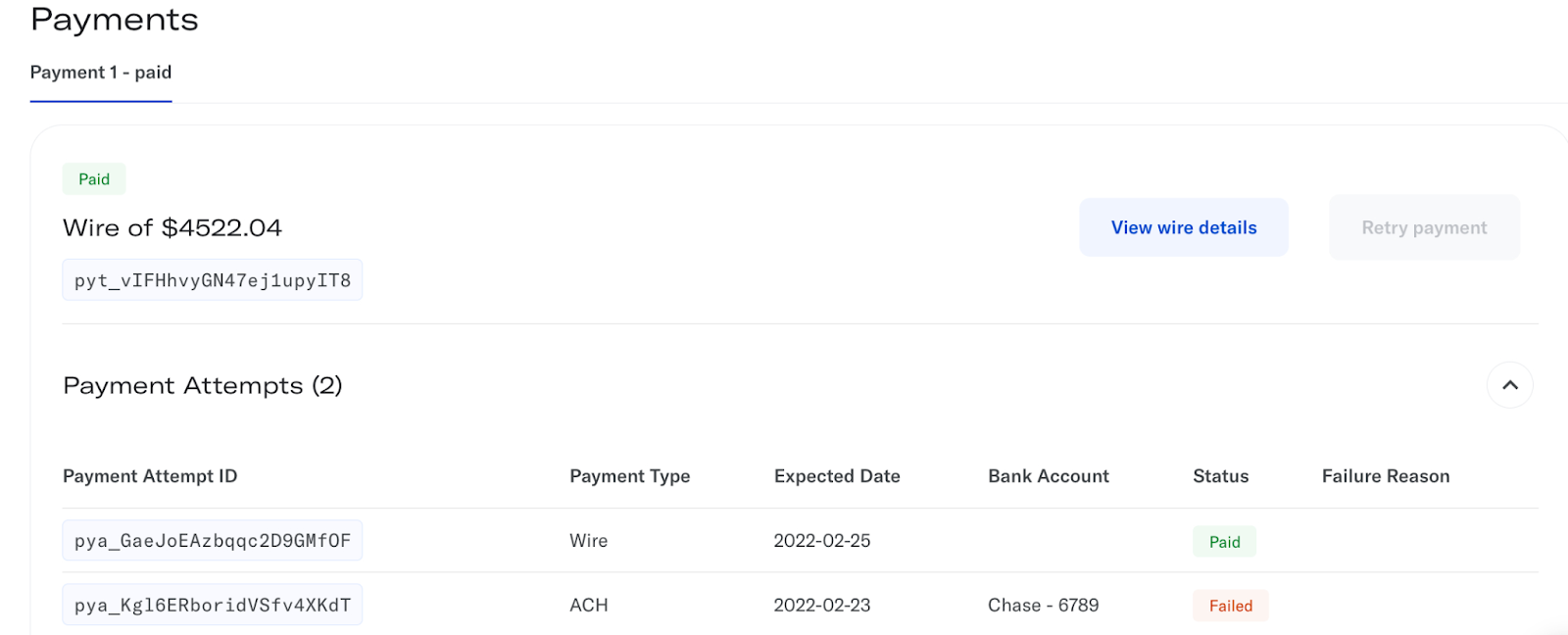

Payment Visibility

Employee wages are one of the biggest operational expenses for employers, and it’s critical that you have transparency into the movement of funds. When you attempt to send a payment to an employee or contractor, you need to know exactly where money is flowing to have peace of mind. With Payment Visibility, we’ve made it possible to view the status of money movement within Check’s API. Which means you can now track payments and their corresponding attempts for completion, see if a payment is successful, and quickly respond if there is an issue.

Failed Payment Recovery

Dealing with failed payments is a burden for our partners, employers, and employees. It requires tracking down and piecing together information, communicating with multiple stakeholders, and moving quickly to ensure payments arrive in time. Now, partners have the ability to quickly flag an issue, and help companies and employees resolve it on their own. Then, through a simple API call or click of a button on Console, the payment can be retried. This eliminates uncertainty and saves time, making it possible to pay employees on time even if there is a failure.

Bank Account Validation

One of the first steps for many employers and employees in the payment journey is specifying a bank account. If there is an issue, a failed payment will occur and payday may never come. To help avoid this, Check now proactively validates all bank accounts added by your employers, employees, and contractors. If validation fails, we’ll automatically notify you so that you can request your users to update their banking details in time for payday.

We hope these features allow you to add flexibility and bring more automation to some of the most common manual tasks in payroll processing. To learn more about these updates, please visit our documentation: Pay Splits, Payment Visibility, Failed Payment Recovery, and Bank Account Validation!

More from the Check blog

Navigating Tax Day: Tips from a Payroll Expert about April 15th

Check's payroll expert Jim Kohl answers the question: What is Tax Day? Take a look at our latest blog to refresh your memory on all things Tax Day.

Read more >

.png)

Demystifying Astronaut Payroll

Astronauts give "non-resident" income a whole new meaning. Our own Jim Kohl unearths the current and future state of cosmic compensation.

Read more >