January Changelog

Zach Zhang

Product Manager

January was a rush at Check! Our teams made improvements to our API and core products, Onboard and Console, while also supporting the ongoing effort of year-start and year-end. This month, we’ve released employee pay splits, SSN duplication checks, and company Start Date validation.

In addition to those features, we’ve also hit embedded payroll support for all 50 states (that’s 50 states, 1267 jurisdictions, and 6829 taxes)! To learn more about this feat, check out our blog post, The Road to 50.

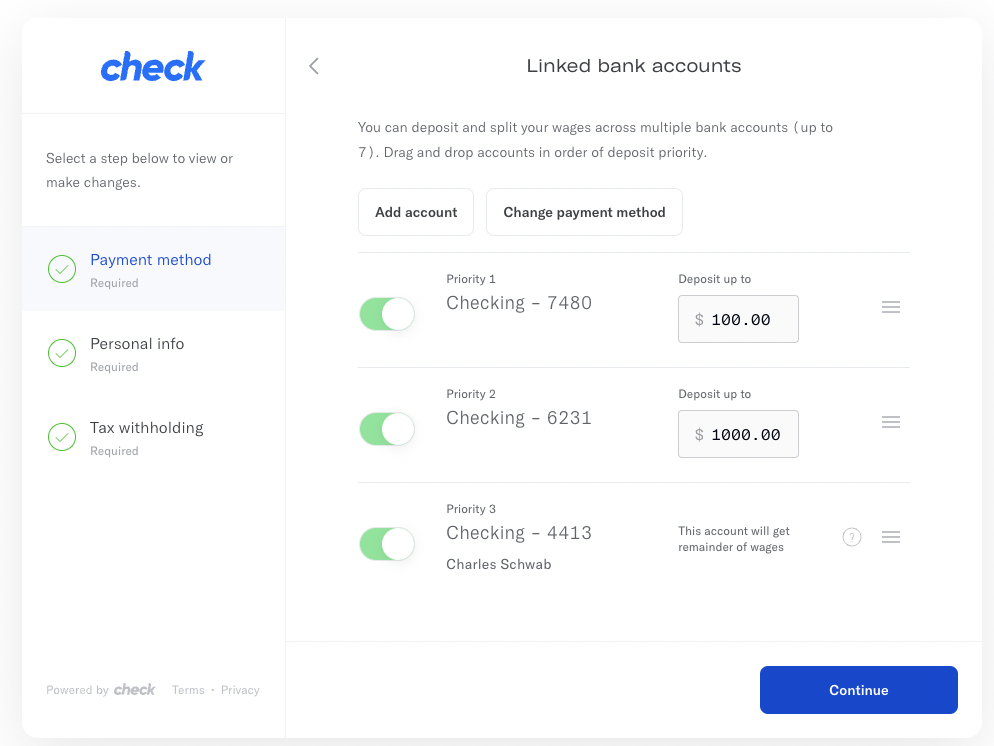

Split employee pay into multiple bank accounts

Check now allows employees to split their pay into multiple bank accounts! This feature is available in Onboard, Console, and the Check API. Employees can split net pay amounts across up to 7 accounts. Here is an example of how a net pay split will work:

An employee configures their net pay splits as follows:

- Priority 1: Wells Fargo checking account ending 4431

- Amount: $500

- Priority 2: PNC savings account ending 2982

- Amount: $300

- Priority 3: Capital One savings account ending 6720

- Amount: Remainder

If the employee receives a net pay of $1000, they’ll receive:

- Wells Fargo checking (4431)

- Amount: $500

- PNC savings (2982)

- Amount: $300

- Capital One savings (6720)

- Amount: $200

See our ‘Net Pay Split’ guide to learn more about employee pay splits.

Prevent employee and contractor SSN duplicates

We've rolled out SSN Duplicate validation to better support customer tax filings. We've also updated our API docs to note the duplicate restrictions now in place. At a high level, the duplicate check prohibits:

- Any single company from having multiple employees with the same SSN.

- Any single company from having multiple contractors with the same SSN/ITIN.

Please note that a single company can have a contractor and an employee with the same SSN, as a company may pay one person as both a contractor and an employee throughout a tax filing period.

We've added further validation to company Start Dates

To ensure that all selected company Start Dates are valid banking days, we’ve added validation to only allow users to select valid banking days. Users will see this change in both our API and Console. If a banking holiday is selected, the following error will occur: "Start date {start_date} must be a valid bank date."

More from the Check blog

Navigating Tax Day: Tips from a Payroll Expert about April 15th

Check's payroll expert Jim Kohl answers the question: What is Tax Day? Take a look at our latest blog to refresh your memory on all things Tax Day.

Read more >

.png)

Demystifying Astronaut Payroll

Astronauts give "non-resident" income a whole new meaning. Our own Jim Kohl unearths the current and future state of cosmic compensation.

Read more >